Lithium battery industry information in August (Part I)

AddTime:2021-08-21 Author:Xinyuren Hits:2517

1. Burst! Ningde era 58.2 billion huge fixed increase "mystery"?

On August 12, the trillion market value giant Ningde times threw out a fixed increase of 58.2 billion yuan, which was like a "nuclear bomb" to bomb the whole investment circle. In addition to 9.3 billion yuan to supplement working capital, all the raised funds will be used for Fuding times lithium ion battery production base, Guangdong Ruiqing times lithium ion battery production project phase I, Jiangsu times power and energy storage lithium ion battery R & D and production project (phase IV), Ningde Jiaocheng times lithium ion power battery production base project (cheliwan project) Ningde times Huxi lithium ion battery expansion project (phase II), Ningde times new energy advanced technology R & D and application project.

58.2 billion, which is not a small amount, even some shocking. You know, this financing scale has exceeded the operating revenue of 50.3 billion yuan of Ningde era in 2020. According to the financial report, the operating revenue of Ningde era in 2020 was 50.319 billion yuan, a year-on-year increase of 9.9%, and the net profit was 5.583 billion yuan, a year-on-year increase of 22.43%. In other words, Ningde era has to do "only earn a fixed increase in money in 10 years".

At present, among the more than 4400 A-share listed companies, only 265 have a market value of more than 58.2 billion yuan. This wave of additional issuance in Ningde era is tantamount to an internal IPO of a large company ranking among the top 300 A shares. In that year's IPO of Ningde era, the fund-raising scale did not exceed 5.65 billion yuan, equivalent to more than 10 times the refinancing amount of that year's IPO.

2. Global "battery shortage"

The "chip shortage" in the automotive industry has not ended, and there has been a shortage of power batteries in the global market recently. Many battery companies interviewed by the global times affirmed the problem of "battery shortage" in the industry. Which link leads to "battery shortage"? How to solve this problem in the future《 The reporter of the global times conducted an investigation. The alarm of battery shortage was sounded at the beginning of this year. In January this year, Tesla founder musk said at the earnings conference that battery supply has become "an obstacle to the popularization of electric vehicles". In March this year, Li Bin, founder of Weilai automobile, said that the battery supply will encounter the biggest bottleneck in the second quarter of this year. In May this year, Ningde times disclosed that there was a shortage of supply of the company's products. Zeng Yuqun, chairman of the company, also said recently that he "couldn't stand the recent rush of customers".

The price of raw materials has increased significantly. Another noteworthy problem is the sharp rise in the price of battery raw materials. Public data show that, as an important material of battery electrolyte, the price of lithium hexafluorophosphate has exceeded 300000 yuan per ton recently, which has doubled compared with the earlier quotation of 100000 yuan / ton. Insiders told the global times that due to the high industry threshold, there was no new effective capacity of domestic lithium hexafluorophosphate in the first half of this year. Industry data show that the new capacity of domestic lithium hexafluorophosphate is mainly concentrated in Tianci materials and polyfluorocarbon, and its new capacity is basically expected to be released in the second half of the year. Lithium hexafluorophosphate is far more than the price increase in power batteries. Western Securities said in a recent research report that the market price of battery grade lithium carbonate was 89500 yuan / ton, an increase of 66.30% over the beginning of this year; The market price of lithium hydroxide was 79800 yuan / ton, an increase of 50.71% over the beginning of this year. The shortage and price rise of these upstream raw materials limit the possibility of battery enterprises to quickly increase a large amount of production capacity.

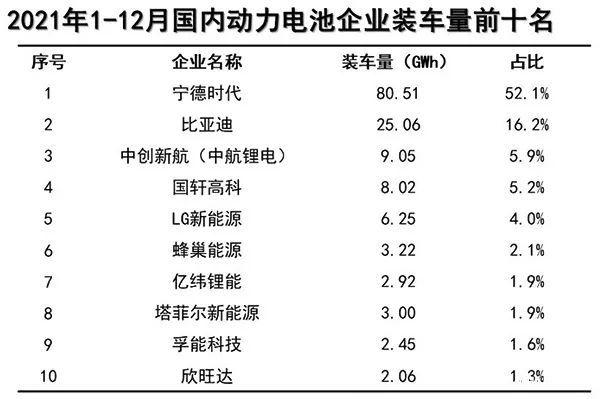

Facing the "battery shortage", battery enterprises such as Ningde times, BYD, AVIC lithium battery, honeycomb energy and Yiwei lithium energy have announced production expansion plans. Statistics show that in the first half of this year, there were 57 investment projects related to the expansion and optimization of production capacity by many power battery enterprises in China, with a total investment plan of more than 350 billion yuan. Overseas, LG Chemical, Samsung SDI, Panasonic and other enterprises have also expanded their production. At present, China is already the largest power battery producer in the world. According to the data released by the Institute of advanced industry research (GGII), in 2020, among the top ten battery enterprises in the world, Chinese enterprises occupied 6 seats, including Ningde times, BYD, AVIC lithium, vision AESC, GuoXuan high tech and Yiwei lithium energy, with a total market share of 41.1%.

3. New progress in Ni MH battery technology

Recently, the Jilin Science and technology development plan project "production and application of wide temperature hydrogen storage alloy and power Ni MH battery" undertaken by Changchun Institute of Applied Chemistry, Chinese Academy of Sciences has made progress.

With the support of key scientific and technological R & D projects in Jilin Province, the scientific research team of Changchun Yinghua Institute has carried out key technical research on the industrialization of wide temperature Ni MH battery materials. After three years of efforts, it has developed three new models of rare earth hydrogen storage alloys and production technologies for wide temperature range, long life and high capacity Ni MH batteries. The maximum rated capacity of high-capacity alloy is 350 MAH / g, and the capacity of wide temperature hydrogen storage alloy at - 45 ℃ and 60 ℃ is more than 80% of the rated capacity. In addition, by optimizing the Ni MH battery technology, researchers have further developed various types of wide temperature Ni MH battery production technology for wide temperature (- 45 ℃ ~ 60 ℃). The discharge capacity of wide temperature Ni MH battery at - 45 ℃ and 60 ℃ is more than 80% of the rated capacity, and the capacity retention rate of this kind of battery is more than 90% after 100 1C charge and discharge cycles at - 40 ℃.

The project has built a large-scale production line with an annual output of 100 ton hydrogen storage alloy and 10 million ah battery, which has realized the industrialization and application of hydrogen storage alloy and wide temperature Ni MH battery. During the research period of the project, 4 Chinese invention patents were applied, and 3 local and group standards were developed. This kind of Ni MH battery has the characteristics of high specific energy, high power, fast charge and discharge, good safety and long life. It can be widely used in power supply systems in electric vehicles, communication electronics and other fields. It can provide a new power supply system for large-scale high-tech equipment, polar investigation equipment and energy storage in high cold / high heat areas, and has broad application prospects.

4. Power battery installed capacity ranking changes pattern evolution undercurrent surge

Being overtaken by LG, Ningde regretted losing the first place. In May this year, thanks to the sharp increase in sales of domestic model y, the installed capacity of power battery of LG energy solutions increased sharply to 5.7gwh, 3.5 times higher than before. It has successfully surpassed the Ningde era and once again ranked first in the installed capacity of power battery since the first quarter of 2020. Moreover, in terms of market share, thanks to the rapid rise in May, the gap between LG energy solutions and Ningde era has been further narrowed. From January to May this year, although Ningde times maintained the top position of market share, it was only 0.5% ahead of LG energy solutions. This shows that the competition for the leading position of power battery manufacturers is extremely fierce. Behind the rise is the rapid expansion of LG energy solutions in the battery field.